Carbon credit certification

What is a carbon credit?

A carbon credit represents one ton of CO2 avoided or sequestered in emissions.

Five key criteria for allocating carbon credits?

Additionality

The feasibility of the project depends on funding from the sale of certified carbon credits

Measurability

The calculation of the quantity of C02 avoided or sequestered is done using a recognized methodology

Verifiability

Avoidance or sequestration of tonnes of monetized C02 must be able to be verified and accounted for annually by an independent third party

Permanence

Avoidance or carbon sequestration must be maintained over time (7 years minimum in principle)

Uniqueness

Carbon credits must be entered in a register in a unique way to avoid any double accounting

What are the advantages of carbon credit certification?

- Carbon credits help to establish a balance between companies/countries that emit greenhouse gases and those that do not emit as much.

- A company (company, country, administration, etc.) emitting less than its quota can sell the quantity it has left to emit.

- Conversely, a company exceeding its quota must buy additional emissions.

- By exceeding its quota, the company has two choices: The first, buy additional emissions, the second, pay a tax for exceeding the quota.

- Hence the importance of the carbon credit market today.

- The objective of carbon credit certification is to create a verified asset that can be marketed and then traded with investors on global carbon markets, for the benefit of project owners.

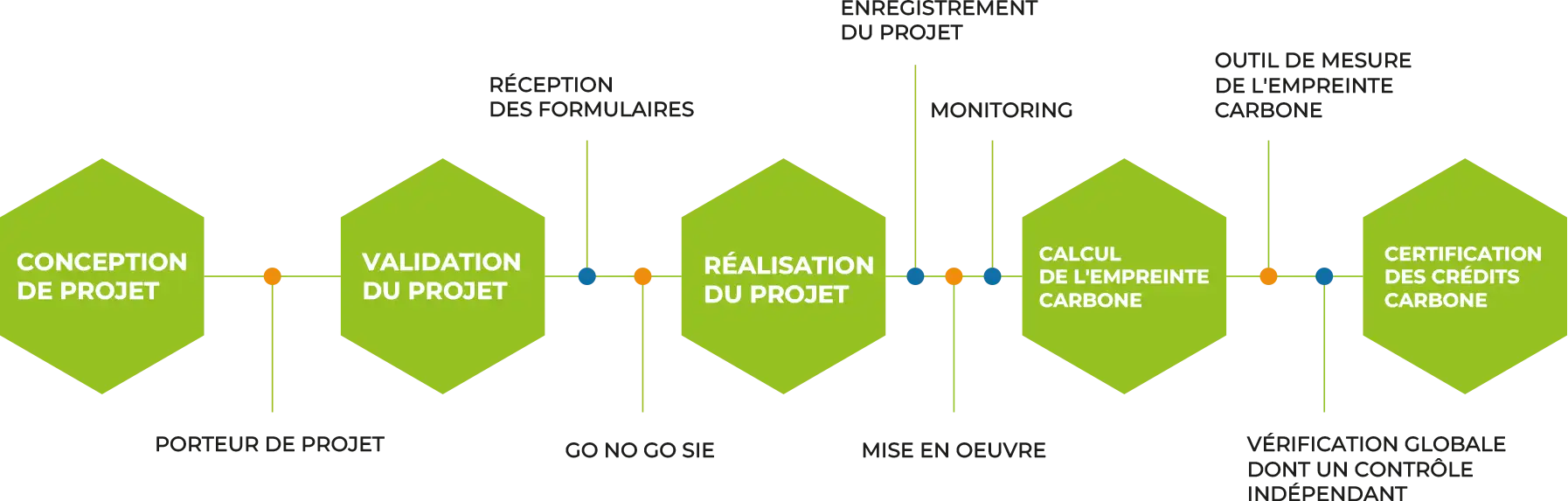

The carbon credit certification process

Certification stages